I was once on a large consulting team working for a high-growth startup. We were working on a critical part of a complex new feature release. This feature was critical to the startup securing a new round of funding. About three months into our engagement, the startup stopped paying its invoices. Despite that fact, my team kept working on the latest release. We reached a release point and delivered the new feature set amid much fanfare.

You can guess what happened next.

The startup was unable to secure that new round of funding, went through mass layoffs, and left us holding over $100k of accounts receivable (AR). The company I worked for at the time was hit hard by the loss and ended up being short on payroll.

Never Again

It was an embarrassing, scary situation for everyone. It left me thinking, “How did we get here? And what can I do to ensure I’m never in this situation again?”

Since that time, I have accrued a lot of experience collecting past-due AR. I’d like to lay out that experience to explain how to mitigate the risk, help you identify any at-risk AR, and show you how to collect on it.

Mitigating Accounts Receivable Risk

The first step to mitigating at-risk accounts receivable is tracking past-due AR in the first place. Identify someone in your organization whose job it will be to track all AR and flag it when it becomes past due. You’ll also need to identify who in your organization is in charge of following up on past-due AR. The person tracking AR and the person following up on past-due AR can be the same. If they aren’t, they should be in close communication.

Next, pay attention to how you contract. Do you have a clause in your contracts that protects you against IP theft in the case where a client doesn’t pay for the IP in full? Avoid the unfortunate circumstance where a client can unlock the total value of the IP you have developed for them—without fully compensating you for your work.

Next, I look at the specifics of the engagement. How long is the project, in total? How long are your terms? Is there a scenario where you could finish the project with a significant amount of AR outstanding? With a smaller project, you may want to bill a significant portion of the project upfront and require payment before you get started. With a longer project, this might not be a concern.

Finally, consider billing your clients incrementally to avoid doing too much work without getting paid. Detailed time tracking and only billing for time spent on the project are valuable tools when working in a professional services firm. As you work and track time, you build a history of delivered value. If you get into a situation where a client wants to dispute an invoice, you have significant documentation to justify the invoice.

Identifying At-risk Accounts Receivable

If you have more than one past-due invoice with a client, you have at-risk accounts receivable.

More than one past-due invoice is a yellow flag, but not necessarily a red flag. From here, you’ll need to carefully evaluate the client and their past-due AR.

As I mentioned above, ignoring this type of problem could endanger your organization. You owe it to your team to effectively and actively pursue any at-risk AR.

Here are two questions that help me identify the riskiness of the AR:

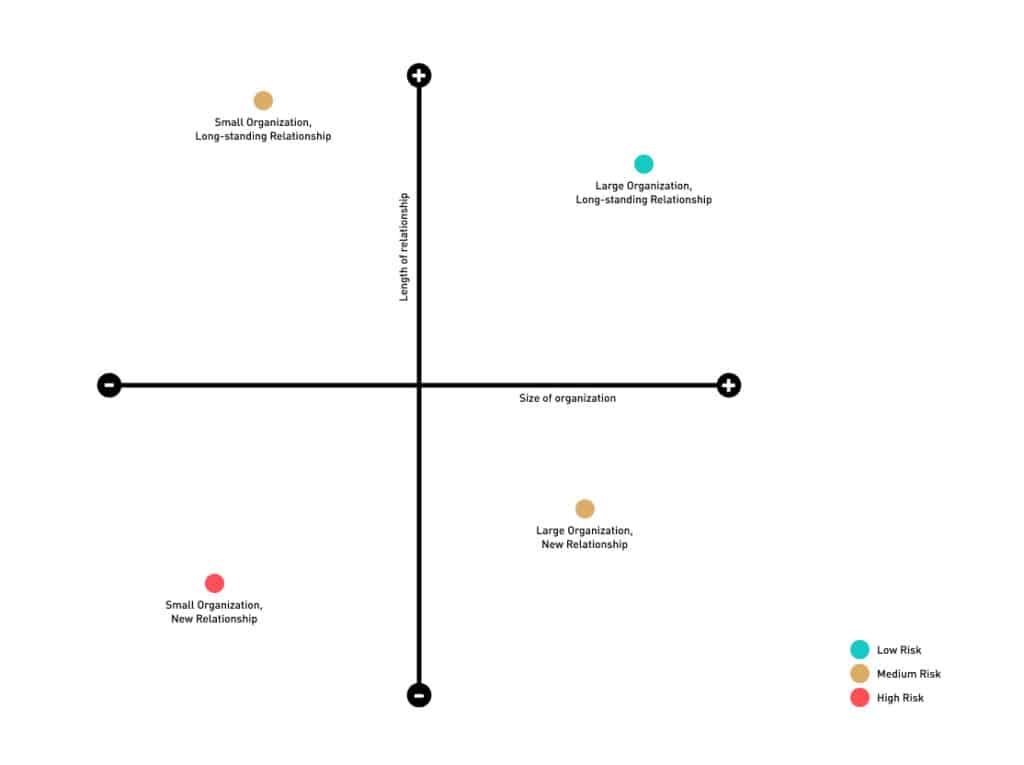

- What’s the size of the client? The potential risk of the AR is a function of the client’s size. The larger the org, the less risk they represent; the smaller the org, the more risk they represent.

- How long have you done business with the client? The longer the business relationship, the less risk exists.

Evaluate your client portfolio as I have above. Client organizations in the lower left quadrant should be treated as high risk. Keep a short leash on their past-due AR. Client organizations in the upper right should be given more leeway and time to address past-due AR.

Remove how you feel about the client relationship from evaluating your at-risk AR. In these sorts of instances, emotion can obscure risk and push you to procrastinate in dealing with the situation. As I said before, you owe it to your team to address high-risk past-due AR as soon as possible.

Now What?

You’ve identified at-risk AR, you have some past-due invoices, and now it’s time to do something about it. Here’s how I would proceed:

1. Talk to the team working on the project.

From their perspective, is there a reason the client might not be paying bills? Did we fail to deliver? Might the client think we failed to deliver? Find out as much as you can from the team before you go speak to the client.

Imagine going to the client to talk about the money they owe you only to find out they are angry about some missed expectation. It’s a lot like stepping on a rake in your yard. Ouch! This is an activity that uncovers a rake before you step on it.

2. Schedule a meeting with the client.

Get a meeting (face-to-face is best) where you can hear a client’s concerns. Sometimes, the past-due AR stems from an innocent mistake or misunderstanding. Seek to repair the relationship first rather than go straight to collecting on a debt.

Once you’ve heard the client’s concerns, tell them what you will do to get them back on track. Sometimes, the simple act of asking for a meeting can secure some AR that was otherwise at risk.

3. Make things right.

If it looks like you screwed up, look to make things right. This might require providing a discount of some sort.

Usually, a small win for the client can significantly increase the possibility that you will collect more than zero.

4. Agree on a plan.

Don’t leave that meeting until the client tells you their plan to get on track concerning payment. They might not follow the plan, but at least you have additional confirmation of intent.

5. Clarify any planned action.

If you can’t get any confirmation of additional intent to pay, inform the client of what your next steps will be. This could include stopping work or delaying the transfer of IP until payment is made.

This is a worst-case scenario that is usually the result of failure on all sides. The project team probably messed up, the client messed up, and you probably messed up by not staying close enough to a project with an at-risk client.

Attitudes to Maintain When Pursuing Past-Due AR

Perseverance – This is the number one attitude to maintain. Sometimes, the only thing separating you from collecting on that past-due AR is effort and determination. Don’t give up on the value your team earned until you receive confirmation that collecting is impossible. Collecting a massive debt may take weeks or months of persistence in emailing, calling, or meeting. You owe it to your team to continue to pursue the value they earned.

Curiosity – Seek to understand what’s going on. What happened on the project? What’s going on in the client’s business? Was there a misunderstanding in invoicing? Rather than coming into a meeting or email exchange looking to blame someone, seek to understand different perspectives.

Optimism – Believe that you can find a win/win scenario in any situation. Maintain a positive outlook as you seek to understand the situation from the client’s point of view and also transparently expose your interests. Look for a mutually acceptable outcome that leaves both parties in better shape.

Assume Positive Intent – There are very few people out there looking to screw you over. Don’t believe that narrative unless you have absolutely no other alternative. Assume that others are operating in good faith just as you are. Believe that the other side is also working to remediate the situation to the best of its ability. Thank them for their efforts on your behalf.

Planning to Protect Your Firm from Accounts Receivable Risk

Bad AR happens to everyone in every organization. The best we can do is hope to minimize its effects on our team and our firm’s finances. By regularly evaluating and mitigating risk, we can avoid bad situations before they happen. Having a consistent process for dealing with past-due accounts receivable and maintaining positive attitudes, we stand a better chance of collecting agreed-upon project fees.

- How to Protect Your Firm’s Accounts Receivable - January 9, 2023

- The Future of Work and the Workplace - October 27, 2021

- Building Custom Software to Gain Strategic Market Advantage - August 26, 2021

- 4 Essential Sales Skills for Service Firm Leaders - December 21, 2020

- Inheriting a Team Successfully by Managing for Growth - April 22, 2019