Atomic Object’s purpose makes it clear that we practice multi-stakeholder capitalism. We strive to be a source of fulfillment for all Atoms and a force for good for our clients and our communities. Since every dollar that comes into the company as revenue must leave via only one door, managers at Atomic wrestle every day with the tradeoffs inherent in our purpose.

I’m convinced that a multi-stakeholder approach improves traditional business outcomes like profitability, so I don’t see our approach as altruistic from the perspective of the shareholders. The classical alternative way of organizing a company is to emphasize profit and shareholder value. Agency theory is the idea that managers are the “agents” of shareholders and manage the company purely for shareholder return. While a singular focus on shareholder return would simplify the problem our managers face, the short-comings and flaws of agency theory have become painfully clear in the last 50 years. Largely in response to these negative externalities, there’s a rising demand for companies to address social, environmental, and community concerns.

I’m happy to see expectations for companies rising. I’m proud to have founded a company that’s striving to achieve the promise and potential of conscious capitalism. My casual observation is that Millennial and Generation Z folks won’t let the status quo they inherited from Baby Boomers persist. That’s good. I do, however, worry that there is an anti-capitalist movement that will inadvertently throw the baby out with the bathwater in its admirable zeal to improve the world.

In this post, I analyze where the $12,000,000 in revenue Atomic Object generated in 2019 ended up. In effect, this is an exploration of our four-dimensional, multi-stakeholder approach.

Four-Dimensional Impact

Being a source and a force is rather abstract. To make things more concrete, we organize our impact into four buckets. These turn our abstract purpose statement into specifics we can talk about and measure. The four buckets also remind us that profit is a critical, but not sole, measure of success and crucial to achieving our purpose. Here are the buckets:

- People

- Product

- Profit

- Place

Our buckets aren’t a perfect taxonomy. In fact, there’s a fair amount of overlap in them. For instance:

- Supporting our employees is good for the communities we live in.

- Being good corporate neighbors helps us find clients to build products for.

- Investing in our people helps us build great products for clients.

- Profit gives us time and money to invest in the other buckets.

Our four buckets help to remind us that we’re not optimizing solely for shareholder return. They are our way to keep the multiple stakeholders we care about visible. Some aspects of our buckets have obvious quantitative measures. Others are more subjective but no less important. What the buckets and the measures don’t provide is a sense of where we stand compared to other companies.

We use B Corp and Evergreen Certification to benchmark our success in managing the company from a multi-stakeholder perspective. External standards don’t align perfectly with our internal buckets. However, we find value in these independent assessments to educate and inspire us and to calibrate our tradeoffs.

Measuring the Buckets

The descriptions below take advantage of our Act Transparently value to share concrete numbers and specific programs or policies. There are plenty of companies who meet or exceed our goal of being a force for good — I offer our data humbly and as nothing more than a complete example. Researching this post made me proud, but also got me thinking of where we could be doing better or investing more effectively.

The pandemic of 2020 prevented us from spending on professional development, social events, snacks, pair lunches, and community sponsorships, among other things. Working from home, we had many fewer sick days and higher billable utilization. In short, our finances were not typical in 2020. From a profitability standpoint, it was our best year ever. Culturally, and from a purpose perspective, it was our most challenging by far. I used 2019 numbers in this blog post as they are more representative of our model.

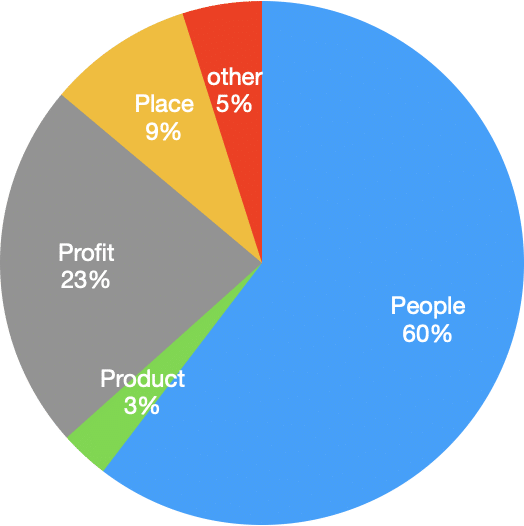

When you think about where each of the $12,000,000 in revenue went, you can readily trace most of them to one of the four buckets. But there’s still $640,000 that doesn’t clearly map to a bucket. Some of that is retained earnings and re-investments. Others are services that the business requires. For example, the money we spend on software services provided by large, distant firms doesn’t fit one of the buckets. While salary goes to the People bucket, I pull out local and state income taxes and put those dollars in the Place bucket. I’m basing my classification on where the money goes initially. Most salary dollars are probably spent locally, but I don’t try to account for that.

Here’s how the revenue dollars initially flow into the four buckets:

|

|

As you would expect in a consultancy, the majority of revenue dollars goes to the people who do the work. The client stakeholder cited in our purpose primarily sees the benefit of the time, expertise, and experience purchased. But, indirectly, they also benefit from the investment of time and dollars into professional development.

In the sections below I describe for each bucket how we spend the money we bring in.

People

In 2019, we spent about half of our revenue on salaries. A total of $6,170,000 was paid to 65 or so people, all of whom work local to their offices. This not only buys houses, groceries, entertainment, and services in our communities, but it funds savings, travel, student loans, and philanthropy. The average annual base wage across the company was approximately $90,400. The average annual overtime pay was $4,500.

We spent $1,300,000 on a comprehensive benefits offering. That includes health and disability insurance, health savings accounts, 401k (3% safe harbor), Social Security, Medicare/Medicaid, unemployment insurance, and workers comp insurance. That’s approximately $20,000 per person.

We spend $2,500 each year so that any Atom, and anyone who lives with an Atom, can have free, confidential mental health services. Equally important to buying the service, we talk about its availability frequently and encourage its use.

While compensation and benefits matter, I believe intrinsic motivation matters more. Intrinsically motivated people are more likely to feel fulfilled. Daniel Pink identifies three essential elements of intrinsic motivation: mastery, autonomy, and purpose. Atoms are supported and encouraged to master their craft, whatever it may be. We encourage and even expect everyone to have a high degree of autonomy in their jobs. Our project teams are self-managing and work directly with their clients. We’re very intentional about our purpose, using it to make important policy decisions and guide the company. I believe our culture and our structure support Pink’s elements of intrinsic motivation.

We take our Teach & Learn value seriously and invested $280,000 in 2019 in direct expenses helping Atoms grow professionally. Our “if you’ll read it, we’ll buy it” policy and our group reading mean we spent another $3,000 on books.

Our investment in training isn’t all technical. We spent $83,000 with consultants to help us all learn more about cultural intelligence. In 2021, we extended this effort to include training and systematic work on diversity, equity, and inclusion. Expanding our awareness on these fronts benefits us individually and the company as a whole. I’d argue it also benefits the communities in which we live.

When we embrace and teach tools like crucial conversations, values, radical candor, and FUDA, we hear stories about how relationships outside of work benefit.

Our employee recognition program is a peer-to-peer means of publicly recognizing and appreciating actions and accomplishments tied to our six values. Recognition is a key part of our purpose. We awarded 73 individual Proton awards in 2019.

Our pair lunch program cost $23,000 in 2019. Pair lunches help build and maintain one-on-one relationships between Atoms. Meaningful social connections are a vital part of our purpose.

Our social connections are further built through monthly office parties, quarterly office dinners in local restaurants, office lunches, and a host of employee-organized events like bike rides and team sports. Spouses and significant others participate in many of these. We spent $88,000 in 2019 on social events.

We want everyone to come to work refreshed and energized. Our strong track record of sustainable pace leaves plenty of time for all the other important aspects of life and helps avoid burnout. Across the company, over the last decade, the average number of hours worked per week per person is 42. Hourly pay for everyone means the company can’t take advantage of individuals through extra, unpaid work.

The results of filling the People bucket show up in our consistently high Gallup Q12 engagement scores, broad participation in our employee ownership plan (45 of 60 people who were eligible in 2019), long tenures, and low turnover. By being a place where everyone is welcome and can feel they belong, we have an unusually high percentage of women for a software development firm. While we don’t yet publish our stats, I’m very happy that what we’ve learned and things we’ve done to ensure that members of the LGBTQ community find Atomic to be a place of belonging have paid off. A few of our Atoms have written about their experiences as employees and even while interviewing.

Product

Helping our clients achieve their mission is the primary focus of the Product bucket.

Time is the most important resource any of us have. That means the primary measure of the Product bucket is the time we spend working to design and develop software products that look great, work great, perform reliably, maintain easily, burnish the brands, and grow the business of our clients. In 2019, that was approximately 93,000 hours. That’s about 45 person-years of work, which is a lot of impact.

Most of the projects we do have a goal of increasing our clients’ revenue through innovative digital product offerings or greater operational efficiencies. If the average return on their investment is 2x in the first 12 months post-project, then our $12,000,000 in revenue represents $24,000,000 in revenue for our clients. That’s obviously a super-simple ROI model and a pure guess at average return, but it does point to the economic impact we have through our clients.

We have always invested in professional development for all Atoms. The $280,000 spent in 2019 primarily went to fund experiences that helped Atoms grow and master their craft, such as conferences and workshops. The opportunity cost of professional development time is substantial. In the short term, we could turn this time into approximately an additional quarter-million dollars of revenue. In the long-term, the investment into professional development benefits both our clients, our people, and the company.

Not all of the communities we are a part of are geographically defined. The design and development communities are national and international in scope. We contribute to open source projects on occasion, though nowhere near as much as other consultancies I know of. We give presentations and publish things we’ve learned in Spin and Great Not Big, our company blogs. In 2019, we paid Atoms for 1,900 hours of time writing for Spin and GNB, at a cost of roughly $82,000.

Profit

We’ve followed the Evergreen 7Ps of the Tugboat Institute since long before I knew about Tugboat. That’s why joining Tugboat felt like finding our tribe. Here’s how they describe Profit:

Not misunderstanding profit as the purpose of the business; but recognizing it is essential to survival and independence, and the most accurate measure of customer value delivered.

Profit shows we remain competitive in achieving our commercial purpose. If you believe that profit is an indicator that a company exploits workers, customers, or the environment, as it seems many people do, you’re likely more sympathetic to an anti-capitalist mindset. In contrast, it’s profit that earns our ability to fulfill our existential purpose. As Max DePree, author and former CEO of Herman Miller, used to say, “No margin, no mission.” Especially for companies that have a positive impact on the world, profit should be celebrated, not demonized.

In 2019 we had net operating income of approximately $2,830,000 on revenues of $12,000,000. For context, we’re a pass-through taxation entity that doesn’t use debt and doesn’t make large capital investments, so this number is pretty close to EBITDA. We distributed approximately $2,680,000 of that and used the balance to buy back shares of departing shareholders, grow our cash reserves, or make investments.

Profit Distribution

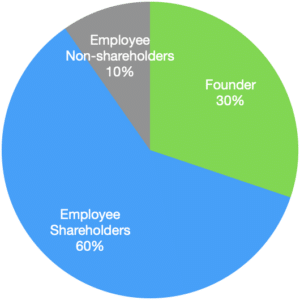

As an employee-owned company, we have three non-overlapping groups of internal stakeholders across which profits are distributed:

- Non-shareholder employees

- Shareholder employees

- Shareholder founder

Our longstanding, de facto employee ownership trust distributed 25% of our net income, or $685,000, to all 65 employees in the form of a 5%-of-salary 401k Profit Share, and equal-amount cash bonuses of $5,952 per person. Our “1/n” approach to quarterly cash bonuses reinforces our culture of team achievement, recognition of all Atoms, and social connection.

We divided the majority of the remaining 75% of profits pro-rata by shares owned and then distributed to our 40 shareholders. The 39 employee shareholders who aren’t company founders received $1,195,000 in quarterly distributions on their shares. Founder shares received $796,000 of distributions.

Employee shareholder wealth goes to things like home improvements, second homes, retirement savings, college savings, vacations, local products and services, and philanthropy. It also results in taxes that directly support our cities and states.

The chart below shows how profit, in general, was shared among our internal stakeholders.

Our de facto employee ownership trust and the Atomic Plan, our non-ESOP approach to employee ownership, together result in the distribution of 70% of our profit to Atomic employees. Non-founder shareholders collectively see twice as much (60% vs. 30%) of the profit as the company founder. For reference, the founder owned 40% of the shares in 2019.

Profitability protects the company through the ups and downs of the business cycle. Without a healthy level of profit, a consultancy is forced to weaken its commitment to employees through either contract relationships or cycles of hiring and layoffs. Historically we’ve never laid anyone off and use contractors only sparingly when we don’t have the right skills or can’t hire. The pandemic of 2020 provided a vivid illustration of the importance of profit as a financial buffer, as we got through that terrible year with no layoffs or salary reductions.

Place

Healthy communities require vibrant economies that generate good jobs. A huge but often overlooked part of being a force for good in our communities is the stable, fulfilling, well-compensated, local jobs we support.

We directly support nonprofit organizations in our communities with our expertise (65% of us), our time ($37,000 paid in 2019), our facilities (dozens of groups hosted), and our money ($78,500 in 2019). We spent $21,000 as members and sponsors of business communities that align with our values. Together, these groups further our craft of software design and development and help make our communities more just and diverse, more fun and beautiful, and economically vibrant.

Choosing local vendors whenever possible supports other local businesses, keeping money in our communities. A conservative estimate of our local spending on services, not counting utilities, amounted to $550,000 in 2019.

At the hyperlocal level, our pair lunch program put $23,000 into restaurants within walking distance of our offices.

In 2019, Atoms paid $239,000 in Michigan state income tax and $44,000 in Grand Rapids income tax. As pass-through entity shareholders pay another approximately $87,000 in state income taxes on their distributions. Atomic paid $33,000 in corporate income taxes and $22,000 in property taxes. That’s $425,000 worth of streets, sewers, police and fire protection, highways, bridges, permits, parks, child protection, universities, K-12 education, etc.

A common criticism of service firms, from an economic development standpoint, is that they only move money around in a community rather than bring it in. However, Innovation services firms with a national client base bring new money into their communities. For many years we have averaged 50% of our revenue coming from within the state of Michigan and 50% coming from elsewhere.

Slicing the Revenue Pie

Our commitment to multiple stakeholders is clear from how revenue flows into each of our four buckets of People, Product, Profit, and Place. Our buckets serve to remind us of our impact and the non-exclusive role that profit plays in our bottom line.

Employee ownership has a significant impact on the breadth of profit distribution to internal stakeholders. Unlike an ESOP, our approach to employee ownership distributes profits quarterly, through a combination of uniform (“1/n”), salary-proportional (401k PS), and ownership (shares). In a follow-up post, I’ll provide a more detailed analysis of the impact of employee ownership on our economics.

Ours is not the only way to organize a professional services firm. What if we were to follow the agency theory approach and manage only for shareholder return? In a subsequent post, I’ll model what our agency theory-inspired doppelgänger would look like and share where the revenue and profits would end up.

- Attention: Spending Your Most Valuable Currency - February 10, 2022

- Slicing the Revenue Pie in a Multi-Stakeholder Company - July 30, 2021

- Commercial versus Existential Purpose - July 19, 2021

- How I Misunderstood Mentorship and Benefited Anyway - June 16, 2021

- Sabbath Sundays and Slow Mondays - June 4, 2021