Editor’s Note: Since this post’s publication, Atomic has further refined its approach to determining a valuation. Keep checking in on Great Not Big as we continue to tinker with and better our model.

Once you’ve decided to sell shares, the most practical question — and to everyone involved the most important — is that of valuation: What’s the company worth?

I spent a year researching this question, collecting valuation models, seeking an authoritative, definitive answer. I stopped seeking when I realized the answer wasn’t a number or an algorithm, but a mutual agreement. For my purpose, shares were worth what I was willing to sell them for, and what other employees were willing to buy them for.

This post is the third in a series on Atomic Object’s ownership and the non-ESOP approach we took to gradually shift from a founder-owned to a broadly employee-owned company.

- Context, motivations, accomplishments to date

- Description of our Approach: Atomic Plan and ESPP

- Valuation

- Financing

- Distributions

- Lessons Learned

- Perspectives of Founders and Employees

- Alternatives and Unsolved Problems

First principles

The best way I knew to reach an agreement was to have a valuation model that was based on first principles, and which was open to examination and testing.

When I thought about the value of Atomic from a first principles perspective, I identified three elements:

- Assets (furniture, computers, cash, AR, investments, etc)

- Liabilities (debt, AP, current payroll, 401k commitments, etc)

- The income stream of future profits

With Atomic, and probably most technology services firm, the assets and liabilities are relatively small and quite easy to value. The only significant and complicated element is the income stream from future profits. That’s also why services firms don’t sell for high multiples of their revenue or earnings. All the “assets” (i.e. people) who produce those profits can leave the firm at any time.

Future profits are determined by factors such as current contracts, client base, reputation, size, operational efficiency, marketing effectiveness, taxes, and market demand. While the individual components of the expected future profits are very difficult to value, taken together, they can be said to have determined past profitability, which is easy to measure, and is a reasonable estimate of future profitability.

Shortcuts to valuation

Many of the 12 valuation models I gathered were simple multiples of key financial metrics like revenue or EBITDA. Inc magazine used to run such an article on a regular basis. It’s easy to conclude from these sources that valuation is a trivial exercise — just do a simple multiplication and you’re done.

What I believe is commonly misunderstood is that these studies are merely reporting on transactions that happened, not what drove or justified the deals. You can calculate that a company is worth 4.5 times EBITDA only after some buyer does the investigation and due diligence, decides what they are willing to pay, then does the division to determine the multiple. The multiple didn’t determine the value, it was merely observed after the fact. The reports that provide these multiples are only useful if they represent many transactions, if the underlying business conditions are similar, and the deals were well done.

Since they are based on market and economic conditions, multiples can vary with factors that have little to do with an individual company. If you were selling the entire company on the open market, then timing would be quite relevant. But that’s not what we were doing. We were selling shares to broaden ownership and perpetuate the existence of the company in the long-term. A first-principles approach is just math done on historical results with assumptions about the future. It isn’t moved by trends and market conditions.

Discounted cash flow (DCF)

Revenue times net margin equals profit. But what about future profits? Since a dollar today is worth more than a dollar tomorrow, a discount of future profits needs to be made. In short, future profits can be predicted from past profits, and the value of that future profit stream can be discounted to map it into a value today. This is known as a discounted cash flow valuation.

We use a 17% discount rate and a 10-year projection of profits. These are probably on the high and long side, respectively. If a buyer were to question the optimism of a 10-year projection, I’d respond by pointing out the company’s history and track record, and the high discount rate. As an intuitive measure of this, I believe many people at Atomic would happily buy $1 of next year’s earnings for $0.83 today.

Since the DCF is just math, the same value could be produced by other parameters of discount rate and number of years of projection. In our case, a 5% discount rate and 6-year projection produce the same present value.

Capital gains versus earnings

When your fundamental business strategy is to be great, not big, then it would be odd to base your company’s value on future growth projections. Venture-backed firms fit into that sort of value; VCs invest with the hope that growth projections come true, not for the profit currently generated.

Atomic’s valuation is one a financial buyer would use. It doesn’t depend on achieving a particular growth trajectory and selling the entire company; instead, it’s based on the financial results that can reasonably be achieved in the future.

For a company with a goal to be 100 years old, it would be pretty silly to buy hoping for a big sale. Instead, Atoms should be buying shares to gain access to the profit stream they produce.

After-tax value

Our valuation is done on an after-tax basis. We reduce future profits and accounts receivable by the amount of tax that will be paid on them. For example, if future profits are worth $10M today, then we reduce that in the model to $7.5M by assuming a 25% effective tax rate.

In truth, I’ve always found this to be strange, and at odds with how people talk about other financial assets. When you think about your salary, I’m guessing you think about your gross salary, not your take home? When you talk about the value of your house, you probably state it in terms of the market value. If you hold shares of Apple, you’d describe the value as the number of shares times the market value, not what you’ll end up with once you’ve paid capital gains taxes.

Using after-tax values makes our valuation more conservative, favoring buyers.

Smoothing historical results

We use the past 16 quarters to calculate an average margin to feed into our model. If our business or the world changed dramatically, suddenly, and permanently, this would become a problem. Using 16 quarters helps smooth out natural variations. It also helps when our margin is reduced by one-time events like buying a building or making an investment. Our simple average may be covering for our lack of sophistication in accounting for operational results versus balance sheet investments.

Stable performance over 17 years also helps make this simple approach work. Our average net margin since our founding is 24.6%. As of Q3 of 2018, our 16-quarter average also happens to be 24.6%.

Our revenue can change quickly as we hire or lose people. We use the trailing four quarters to estimate annual revenue and feed that into our model.

Factoring in growth

We assume a pseudo-inflationary rate of growth of future revenues of 3%. This is a significant aspect of our model.

We are not pricing into shares any future growth in the company’s size and hence revenue, since we never set growth goals. For a company with a CAGR since founding of 22.4%, that makes our model conservative and generous towards buyers.

Mechanics

We update our valuation model every quarter. This schedule is driven by ESPP purchases. A positive outcome of needing to do this every quarter is that we’ve gotten better at doing it. Before ESPP, we only updated the model when I was going to make an offering in the Atomic Plan. That happened sporadically, so each time was somewhat painful.

Bugs

While the spreadsheet model of our valuation isn’t terribly complex (see “What’s your company worth?” for the spreadsheet), we’ve found there’s a lot of subtlety and complexity in the model.

Since 2009 when we first used it, we’ve found and fixed several significant bugs. Luckily (for buyers) all of the errors reduced share price. These mistakes argue against the homegrown approach we took, as presumably a professional appraisal firm wouldn’t make them. On the other hand, I suspect you’d end up with a one-size-fits-all valuation.

Investment assets

I said above that the assets and liabilities of a technology services firm are generally small compared to the value of future profits. Ignoring past investments we’ve made, and the building in Grand Rapids we bought three years ago, the valuation model reduces to future profits, cash, AR, AP, and stuff like office furniture. Future profit is 86% of the sum of these things.

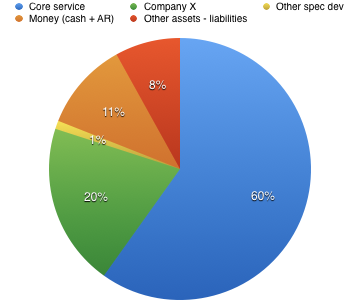

The chart below shows the weighting of all assets in our valuation model.

As the graph shows, the actual weight in Atomic’s enterprise value of the future profits of our core business is only 60%, substantially lower than it would be if we didn’t make investments.

While valuing a building (and its corresponding mortgage) are straightforward, valuing investments we’ve made in other companies is much harder. One of those investments, Company X in the chart, also represents a substantial fraction of our total company value. That particular company is a software firm we co-founded in 2007. It’s been quite successful, has grown substantially, and until this summer when we sold part of our ownership in it, represented 30% of Atomic’s value.

You can see the effect on share price of this investment in the graph below. The red line shows the value of shares if you subtract Company X from our overall enterprise value.

A challenge shown in the graph above is that, even with Company X down to 20% of total value, employees buying shares today are buying much more than a simple service business with a few hard assets. This can be a problem when the risk tolerance of the purchaser is at-odds with the risk profile of the investment.

Owning investments in a separate entity would solve this problem. But with our large base of employee owners (currently 37 people), these investment entities would have many shareholders. Currently, when shareholders leave the company they must sell their shares back. What would happen with these investment-only entities? If they didn’t sell, then we’d become responsible for shareholder rights and communication with people who no longer worked at the company. This is an unresolved issue for us.

Close readers of this post will notice that we carried Company X at a value of $0 for the first four years of its existence. To be conservative, we waited until we saw clear evidence of the success and value of this company before we added it to our valuation model. Since 2012 we’ve used funding rounds of this company to value our shares.

Compared to market value

I have been able to compare our valuation to market price when I’m aware of a transaction, or a firm expresses interest in Atomic, or someone else shares their experience.

A leader of a large technology consulting firm recently told a small group (including me) that his firm acquires consultancies for 1-2x revenue.

Ryan Stewart recently blogged about the value of the web agency he sold. His was a thoughtful approach that ended up at a multiple of 2.5x EBITDA on top of extrapolating past growth 3 years into the future.

By comparison, our valuation at the end of 2017 was approximately 5x that year’s EBITDA, and 1.3x revenue. This is enterprise value, including substantial investments assets.

I believe our valuation for the core service business is discounted from market value by between 30 and 100%.

Another way to gauge company value is by looking at first-year dividend yield. I calculate this by dividing the dividend distributed on a share by the cost of a share that year. Since the cost of shares since 2011 has included a growing investment component (Company X, for example, currently at 20% of total), and those investments don’t generate any ongoing return, the dividend yield is actually depressed by them. Presuming the investments eventually pay off, the dividend yield underestimates the worth of the shares.

The first year dividend yield on Atomic shares has averaged 18.4% since 2009.

Conclusion

We’ve been using our valuation model for transactions for nine years. Will it change in the future? Is it accurate? Hard to say. Consistency is one of the things that establishes its credibility. Accuracy is in the eye of the buyer and seller.

The post “What’s your company worth?” has more details on our model and a spreadsheet you can download.

- Attention: Spending Your Most Valuable Currency - February 10, 2022

- Slicing the Revenue Pie in a Multi-Stakeholder Company - July 30, 2021

- Commercial versus Existential Purpose - July 19, 2021

- How I Misunderstood Mentorship and Benefited Anyway - June 16, 2021

- Sabbath Sundays and Slow Mondays - June 4, 2021