Innovation service companies, like Atomic Object, sell their time and talents to help clients grow revenue or expand a market through the creation of software. Without products of their own, innovation service firms have no financial leverage: it’s an hour out, a dollar in. Like a shark that can’t stop swimming or it will drown, service firms need to keep moving through a steady stream of projects to remain in business. Lack of financial leverage means that to be sustainably successful, an innovation services firm needs to maintain an excellent track record, market-relevant skills, and a pipeline of future clients and projects. The inexorable pressure to find projects and execute them well, which I see as valuable, also inevitably inspires owners of such companies to think of ways to generate recurring revenue.

Software service firms naturally look to create software products in their quest for the holy grail of recurring revenue. Unfortunately, the fundamental differences between product and service companies makes doing both under one roof very difficult. I only have anecdotal data, but my observation is that most service firms either fail at creating and maintaining successful products, or convert entirely to product companies and drop their service offering. A well-known and very successful example of the conversion strategy is 37Signals. I know many more cases of service firms that have failed to establish successful mixed service/product companies — this is a hard nut to crack.

Spec dev

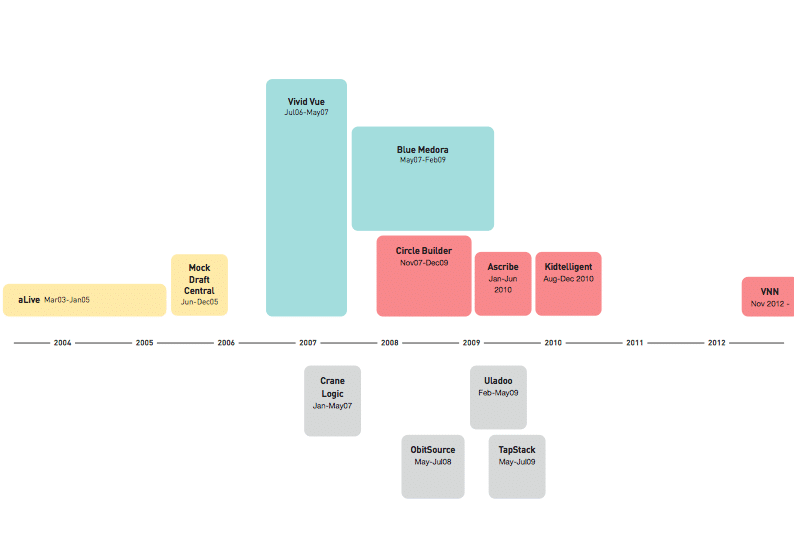

Atomic has pursued a partnering strategy to increase our financial leverage while respecting and nurturing our services core. We do this by giving up some project revenue in exchange for equity, a royalty, or a revenue share. By taking on some of the market risk alongside our clients, we are exposed to the potential upside of the product we help create. We’ve been making speculative development investments, or “spec dev”, as we call them, since 2003. In that time we’ve made 10 investments, and are on the cusp of an additional two. The image below is an approximate graphical representation of our spec dev investments. Projects colored yellow generated some returns, but weren’t particularly good investments. Gray projects were complete losses. Blue projects were very good investments and Red are too early to judge.

The internal rate of return of Atomic’s portfolio has been approximately 27% to date. Several recent investments are too early to have paid off, and my return calculation doesn’t include any future value for existing investments. This rate compares very favorably to the single digit or even negative returns that venture capital funds have averaged in the last decade.

The Shining Star

Blue Medora is Atomic’s most successful partnership to date. The company makes middleware that allows monitoring and management systems to connect with critical enterprise applications like PeopleSoft, Siebel, Citrix XenServer, EC2 and SAP. Having grown to 12 employees on a solid royalty business with IBM, Blue Medora’s CEO, Nathan Owen, saw the opportunity to leverage their expertise and grow the business substantially in the Oracle market. Rather than slow organic growth funded by earnings, Nathan and I decided to pursue our first outside funding for the company.

Blue Medora closed on an investment round of $1,250,000 at the end of 2012. We’ll use the money to hire staff and build product to exploit the Oracle opportunity. In addition to the satisfaction of a quick, successful, capital raise (3 months from pitch to close), I’m particularly happy that we were able to raise all the funds locally, in West Michigan. Start Garden invested $500,000, its biggest single investment to date. Grand Angels came in with $725,000 from approximately 20 of its members and its co-investment sidecar fund.

How we play

We never commit more than 10% of our capacity to spec dev investments, so we’re not gambling with the company’s existence. We hold the assets in the company’s name and run our returns through our standard profit sharing plan, so everyone in the company benefits when they pay off. We value our spec dev assets very conservatively for the purposes of our internal ownership sales. We report on our investments at every company quarterly meeting.

I recently gave a talk in Detroit for a D-NewTech meeting where I described our spec dev strategy, what we look for in partners, lessons we’ve learned, and how our portfolio of investments has performed. My talk starts around the 5:00 minute mark of the video.

Our spec dev investments have not only boosted our financial results, but they have become an interesting and valued part of what working at Atomic means.

- Attention: Spending Your Most Valuable Currency - February 10, 2022

- Slicing the Revenue Pie in a Multi-Stakeholder Company - July 30, 2021

- Commercial versus Existential Purpose - July 19, 2021

- How I Misunderstood Mentorship and Benefited Anyway - June 16, 2021

- Sabbath Sundays and Slow Mondays - June 4, 2021