As a small software agency, we deal with a lot of cash flowing in and out of our business. Probably unsurprisingly, our largest operational expense is our employee’s salaries — that outflow hits our books with a regular biweekly cadence. While payroll is regular, our income is more irregular. We work with a lot of different clients, and to do business with some of them we must accept unusually longer payment terms. In this post, I cover the historical strategies we’ve used to manage cash flow and remain healthy and how we’re adjusting as the business environment and our client mix shifts over time.

Our Past Approach

Early in our history, our founder Carl Erickson created what he called a “Rainy Day Fund” (RDF). The purpose of the RDF was to insulate us from cashflow problems caused by lower than usual utilization (e.g., not keeping people busy on client projects), macroeconomic downturns in demand (e.g., the Great Recession), irregularities in invoicing cycles, or clients being slow to pay (e.g., the check got lost in the mail). The formula for the RDF was simple:

RDF = 2 * Total Monthly Operating Expenses

The RDF formula mandated that we hold two times the company’s total monthly operating expenses on hand. Furthermore, it could be compromised of any proportion of cash and accounts receivable (AR). I reviewed our history since 2015 and found that, typically, 40% of the RDF was cash and 60% was AR. We calculate this value every quarter and, based on the formula, distribute or retain additional money.

The RDF protected us from ever having to draw from our company’s line of credit. We found empirically that 2x operating expenses was more than what was required to run the business. We made the decision to drop the RDF to 1.5x monthly operating expenses. This approach persisted until this year.

Pandemic and the Shifting Business Environment

When the COVID-19 pandemic hit us in 2020, we saw our outstanding AR increase rapidly. Two primary issues were at play: (1) Some client operations were thrown into temporary disarray as they shifted to remote work, and that included their accounts payable departments. (2) We temporarily suspended in-person work and set up mail forwarding. Item (2) was one of the few very obvious mistakes we made in 2020, as the postal system in Michigan experienced major delays. The AR on our balance sheet was growing in large part because the check was “stuck in the mail.”

We responded to the financial impact of the pandemic with a renewed focus on collecting slow-to-pay AR and purchasing AR insurance. We also focused on retaining two quarters of earnings in additional cash reserves (we called this our “cash backstop”). These actions gave us confidence that we could ride out the economic storm in 2020. Happily, our business remained strong, and we distributed the cash backstop in 2021.

The pandemic wasn’t the only factor affecting our cash flow. We grew increasingly worried that project terms were shifting and the 1.5x expenses approach of the RDF wouldn’t work as well going forward. However, we wanted a data-driven approach to measuring what we were feeling.

Day Sales Outstanding

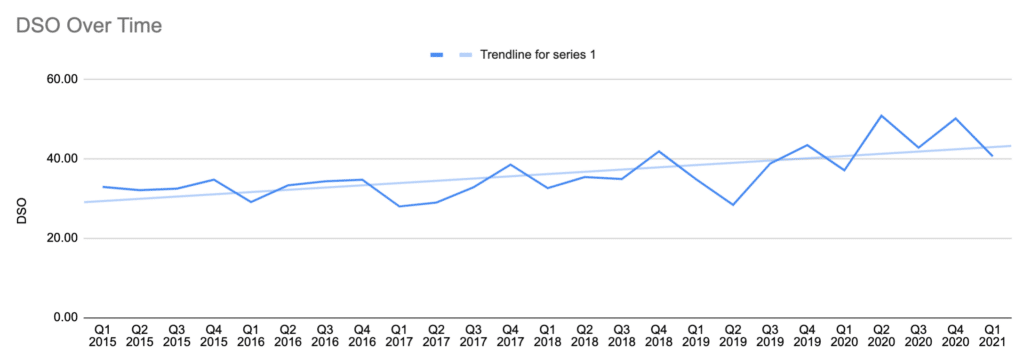

Day Sales Outstanding (DSO) measures the number of days it takes for a company to receive payment for a sale. We calculated our DSO from 2015 through 2021 and discovered a clear trend upward from approximately 32 days to 42 days in the time period.

The trend is a result of clients pushing for longer payment terms. We don’t have any reason to believe this trend will change, so we adjusted our approach from the historical RDF. DSO gave us a great piece of data that we now use to adjust our working capital.

New Approach with DSO

After our experiences in 2020, we agreed that a change in our historical RDF approach needed to be made. Several realizations lead us to this conclusion:

- The RDF was misnamed. What we call the RDF is actually an amount of working capital we retain to help us operate the business. We’re changing the name from RDF to our Working Capital Fund.

- We’ve seen an upward trend in our client’s net payment terms. Our current portfolio of clients doesn’t pay us as quickly as in years past. We needed to create an algorithm to size our Working Capital Fund that would be responsive to changing terms as our portfolio shifts over time.

- At some points last year we had unusually large amounts of outstanding AR. Another signal.

I worked with my fellow Atoms, Adam Medema and Mike Marsiglia, to create a better algorithm for sizing our Working Capital Fund using DSO. Since DSO is the average number of days it takes a company to receive payment for a sale, we developed a logical way of calculating the size of our Working Capital Fund:

Working Capital Fund = DSO * Daily Cash Requirements * 1.2

Where “Daily Cash Requirements” is the average amount of money we spend per day. The 1.2 value is a multiplier that represents an extra 20% buffer. We decided the buffer was prudent to include as we make this change. The multiplier is also a lever we can adjust in the future.

Like before, the Working Capital Fund will be made up of both Accounts Receivable (AR) and cash on hand. Also as before, we will update the Working Capital Fund formula each quarter and compare it against our current cash + AR on hand to determine how much additional cash to distribute or retain.

Going Forward

We’ll continue to monitor our DSO and cash on hand. Philosophically, we don’t want to retain more funds than the company needs for operations or can reasonably be used for growth. If we feel we’re retaining too much cash in the company, we’d prefer to distribute it to our 44 employee shareholders and allow them to invest/save/spend however they wish.

- Using Day Sales Outstanding to Manage Working Capital - September 16, 2021

- Adding a Socially Responsible Fund to Atomic’s 401(k) - February 12, 2020

- Showing hospitality during software development - November 20, 2018